Get on the Property Ladder:

Your No-BS Guide for a

First-Time Buyer

Your Home, Your Future, Our Mission

Your Home,

Your Future,

Our Mission

Who We Are?

We're not just another stuffy financial service.

We're your long-term financial wingman, committed to helping you smash your property goals from your first step onto the ladder right through to your forever home.

Our Promise To You

From your first nervous mortgage chat to your last remortgage decades from now. We're not just processing paperwork – we're helping you build your life, one mortgage at a time.

Your home journey starts here.

Let's make it legendary.

What exactly is a mortgage and why should I care?

Let's be real – buying your first home isn't just about bricks and mortar.

It's about creating your own space, building wealth, and taking a massive adulting milestone.

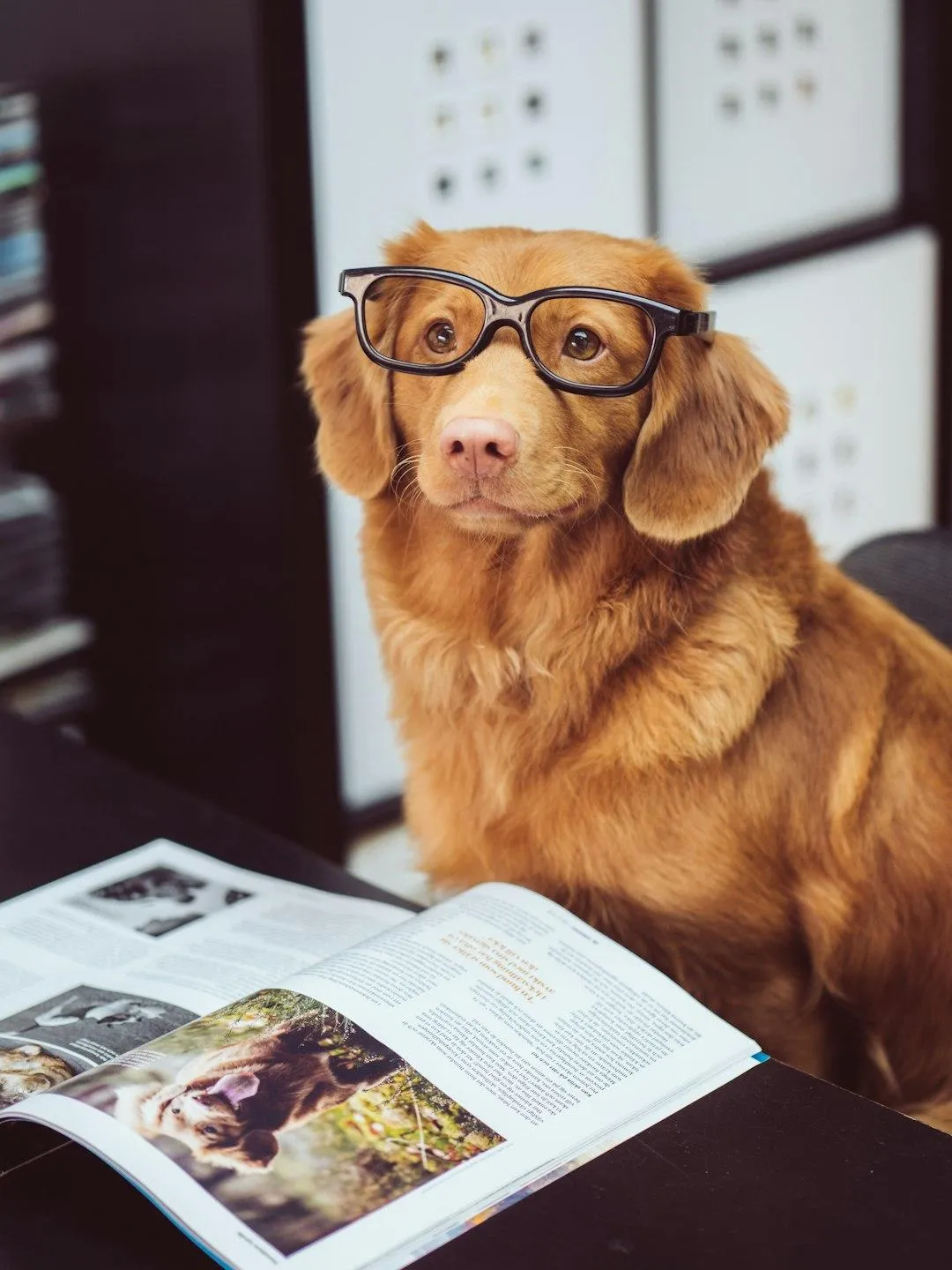

The Mortgage Dog is here for the entire ride – from your first nervous mortgage application to your last remortgage 25-35 years down the line.

#Loyal

Your home may be repossessed if you do not keep up repayments on your mortgage.

STILL NOT SURE?

Frequently Asked Questions

First-Time Buyer FAQs

How Much Deposit Do I Actually Need?

Forget everything you thought you knew about deposits.

The market is more flexible than ever:

Traditional 5% & 10% deposit options still exist and are the most common.

Skipton Building Society currently offer a mortgage for renters with £0 deposit requirement

Accord Mortgages has innovative low-deposit solutions (from as little as a 1% or £5000)

Concessionary purchase options allow buying from landlords or family with potentially £0 deposit contribution from you.

These new options mean homeownership might be closer than you think:

Rental history can now replace traditional deposit requirements

Some lenders are looking beyond standard deposit models

Unique schemes are opening doors for first-time buyers who might have been locked out before

The bottom line? Don't let the deposit myth stop you.

We'll help you explore every single option to get you into your first home.

What Government Schemes Can Actually Help Me?

The government wants you to own a home. Seriously.

Check these out:

Shared Ownership: Buy part of a property, pay rent on the rest

First Homes Scheme:

Discounted properties for local first-timers

Lifetime ISA: Save £4,000 a year and get a free 25% bonus from the government

5% Deposit Mortgage Guarantee Scheme:

Your ticket to homeownership We'll help you hack these schemes and find your perfect entry point.

How Much Can I Borrow? (And Not Break the Bank)

Mortgage lending isn't dark magic.

Here's how it works:

Typically, lenders offer 4-4.5 times your annual income

For a £50,000 salary and 10% deposit, you could qualify for the First Time Buyer Boost! borrowing up to 5.5 x income = £275,000

Your credit score, spending habits, and financial history matter

We'll help you understand exactly what you can afford – no surprises

The Hidden Costs Nobody Talks About

Buying a home isn't just the mortgage.

Budget for:

Stamp Duty (first-time buyers currently get stamp duty relief!)

Legal fees

Mortgage arrangement costs including broker fees

Surveys and valuations

Moving expenses Initial home setup

Budget around £2,000-£5,000 for these extras.

We'll help you navigate and potentially reduce these costs.

Credit Score: Your Financial Superpower

Your credit score is like your financial tinder profile. Make it look good:

Higher score = better mortgage rates

Simple wins:

Get on the electoral roll

Keep credit card balances low

Pay bills on time Avoid credit application spam

We'll be your credit score personal trainer, helping you flex those financial muscles.

Joint Borrower, Sole Proprietor: Your Secret Weapon to Homeownership

Welcome to the game-changer for first-time buyers: Joint Borrower, Sole Proprietor (JBSP) mortgages.

This isn't just another mortgage option – it's your potential ticket to getting on the property ladder.

How does it work?

Up to 4 people can be on the mortgage

Only one person needs to be on the property deeds

Parents, siblings, or friends can support your mortgage application

Combines multiple incomes to boost your borrowing potential

Helps overcome challenges like lower individual earnings or limited deposit

Real-world scenarios where JBSP shines:

Parents helping their children buy their first home

Friends combining financial resources

Couples where one partner has a more complex income situation

Individuals with lower individual income but strong family support

Key benefits:

Potentially borrow more than you could alone

Overcome stricter lending criteria

Flexible option for complex financial situations

Pathway to property ownership that traditional mortgages might block

Potential considerations:

All named borrowers are financially liable

Credit histories of all borrowers are considered

Some lenders have maximum ages if you have older parents

Clear exit strategy is crucial Legal and financial advice recommended At The Mortgage Dog, we'll help you navigate the JBSP landscape, ensuring you find the perfect solution to turn your homeownership dreams into reality.

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE.

There may be a fee for arranging a mortgage and the precise amount will depend on your circumstances. This will typically be between £299-£699.

The Mortgage Dog Ltd (FCA Number 788976) is an Appointed Representative of Stonebridge Mortgage Solutions Ltd, which is authorised and regulated by the Financial Conduct Authority. The Mortgage Dog Ltd. is registered in England and Wales under company number 12306191 at the registered address 41a Spout Lane, Washington, NE38 7HP. Not all Buy to Let Mortgages are regulated by The Financial Conduct Authority

To view our Privacy Policy click here